ADA Website Accessibility Tax Credits: Find Out How To Maximize Tax Benefits And Expand Your Website’s Audience While Avoiding Litigation

Sep 15, 2020Co-authored by Carl I. S. Mueller, Esq., The Maloney Firm, APC, Ike Song, and Daryn Harpaz

As the September and October deadlines to file 2019 taxes rush by, it is important for business owners to start considering how they can maximize their 2020 tax benefits.

.

With much of Southern California still in quarantine and interacting with the world almost completely online, businesses must make sure their websites are compliant with the Americans with Disabilities Act (ADA) to avoid potential lawsuits. Additionally, small business owners that have remediated their websites to comply with the ADA may be eligible for a tax credit of up to $5,000. With ADA Website accessibility lawsuits on the rise, understanding all potential tax benefits available to small businesses is essential during the COVID-19 pandemic.

.

“Tax credits” are a dollar-per-dollar reduction on your tax liability, whereas a “tax deduction” simply lowers your taxable income. The ADA tax credit can be taken in conjunction with many other tax credits, including the Research and Development Tax Credit (R&D Credit). R&D and ADA credits are commonly found in businesses with computer programming, manufacturing, and product development. These credits can be taken retroactively, but they also expire.

.

Specifically, 26 U.S.C. § 44 allows an “eligible small business” to receive a 50% credit on expenditures for the purpose of increasing access under the ADA, for a maximum credit of $5,000. To be eligible, a business must have gross receipts under $1,000,000 or less than 30 full time employees, and have incurred expenditures “for the purpose of removing architectural, communication, physical, or transportation barriers which prevent a business from being accessible to, or usable by, individuals with disabilities.”

.

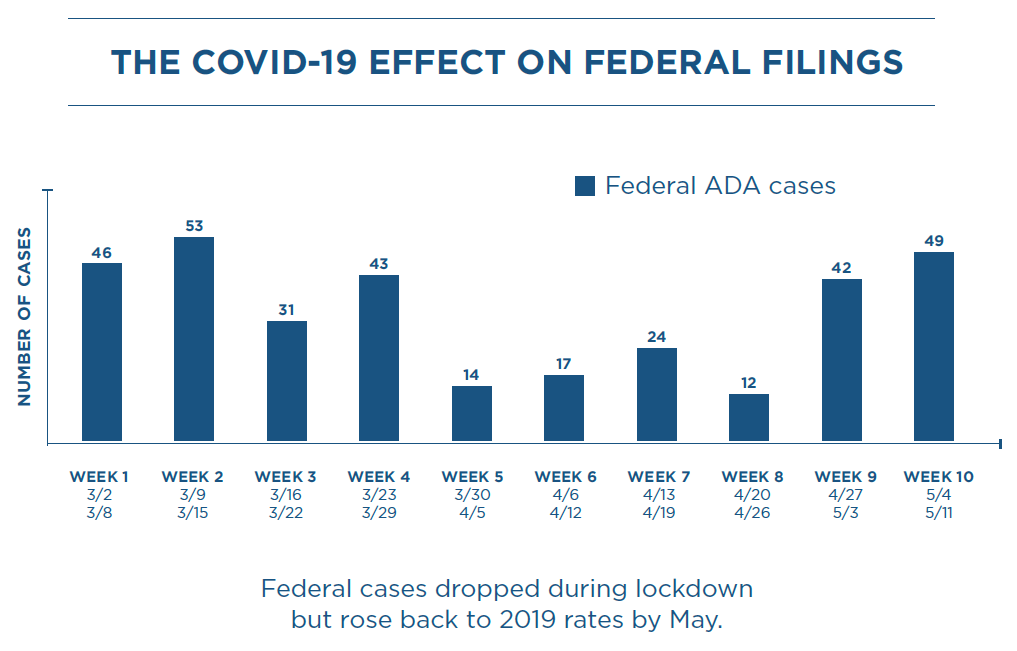

While many companies are understandably avoiding all additional expenses during the current economic crises, website ADA cases and demand are not going away. California now has the most cases filed of any state, with cases being filed in both California State Court under the Unruh Civil Rights Act and Federal Court under the ADA. And, as shown below, while complaint numbers were down during the lockdown, they have started rising again.

.

.

Using the tax credit under 26 U.S.C. § 44 allows businesses to save money on improving their websites, by making them accessible to a wider audience. Since businesses can claim a 50% tax credit for costs incurred in improving the accessibility of the website, they can proactively avoid a potential lawsuit, and potentially even claim a tax credit for the legal fees incurred in defending an ADA claim. In summary, while COVID-19 forces more commerce online, it makes financial sense for businesses to make sure that their digital platforms are accessible.

.

Ike Song is a tax attorney based in Orange County obtaining tax credits for business owners and defending them against the IRS. Contact him at is@skylawfirm.net or 949-610-7425. If you would like to speak to an expert on ADA website accessibility, please contact daryn@zenythgroup.com or call 310-400-0194. If you need further legal guidance or are facing litigation, please contact Carl Mueller, Esq., of The Maloney Firm, APC at cmueller@maloneyfirm.com or at 310.540.1505.

.

Disclaimer: This article is not intended to be and is not legal advice or tax advice. You should not rely on the information in this article as legal advice or tax advice. Rather, please consult the appropriate professional. Reading or receiving this article is not intended to and does not create or imply an attorney-client relationship.

.