California Enacts Bill Extending AB5 Exemptions

Sep 11, 2020

Just eight months after California businesses began to adapt to the rigorous new standards for classifying workers as independent contractors under Assembly Bill 5 (AB5), California lawmakers have enacted AB 2257, which creates additional exemptions for certain occupations and contractual relationships from the restrictions that AB5 posed on many employers and workers. Importantly, AB 2257 upholds the ABC Test for classifying independent contractors, with additional exemptions. Find out more about how AB 2257 affects California businesses and workers below.

.

Brief History of AB5

.

In response to concerns about the rise of the gig economy in California, AB5 (also known as the “gig worker bill” and the independent contractor law) was signed into law by Governor Gavin Newsom on September 18, 2019. The bill, which went into effect on January 1, 2020, created the ABC Test for determining if a worker is an employee or an independent contractor under California law. The bill originates from the California Supreme Court’s groundbreaking Dynamex Operations v. Superior Court ruling in 2018, in which the Court outlined the significant losses employers, workers, and the state incur as a result of the misclassification of workers as independent contractors.

.

Workers’ designation as employees or independent contractors determines their ability to access worker’s compensation benefits and social security plans, as well as other significant workplace protections. In the text of AB5, the Legislature cites “the misclassification of workers as independent contractors” as a “significant factor in the erosion of the middle class and the rise in income inequality” in California. AB5 reclassified millions of California workers previously considered independent contractors as employees in order to grant them access to workplace protections offered by employers to employees. Many industries found these restrictions problematic and have sought additional exemptions.

.

How does AB2257 Amend AB5?

.

AB2257 does not make any changes to the structure of the ABC Test created by AB5, and the ABC Test is still considered the standard for classifying independent contractors under California law. However, swift and acute backlash against the bill has led the state to create several new exemptions from the ABC Test. Businesses exempted from using the ABC Test are required to use the Borello test, which is significantly less rigorous than the ABC Test, to classify their workers as independent contractors. Some significant exemptions that AB2257 creates or amends are:

.

- Business-To-Business Contracting Relationship Exemption:

- The exemption included in AB5 for contracts between business service providers and businesses is expanded to include public agencies, quasi-public corporations, and a few other arts-related industries. This exemption remains largely unchanged from its status in AB5, and upholds the 12 mandatory criteria established in AB5 for qualifying for the exemption. “Single-engagement” business-to-business interactions, as well as some relationships wherein one individual contracts with another individual to perform services at “a stand-alone non-recurring event in a single location, or a series of events in the same location no more than once a week” may also be exempted from the ABC Test.

- Referral Agency Exemption:

- AB2257 upholds, clarifies, and extends the exemption for referral agencies. The phrase “shall include, but are not limited to” is added to an expanded list of referral services that are exempt from the ABC Test. The bill also stipulates that the ABC Test will be used to determine if the worker is an employee of the referred contractor or the client to which the contractor was referred.

- Expanded List of Exempted Industries:

- In addition to the industries originally exempted in AB5, AB2257 provides exemptions for many industries related to the music and performing industries, professional services, and other miscellaneous industries, including, but not limited to:

- recording arts and music

- performing arts

- landscape architecture

- translation of documents

- copy editing and illustrations

- registered professional forestry

- appraising

- home inspections

- insurance underwriting inspections, auditing, and risk management and loss control

- manufactured housing sales

- international and cultural exchange services

- competition judging

- digital content and feedback aggregation

- master class performance

- AB2257 also removes the limit on submissions that would cause workers to lose their independent contractor status, and instead stipulates that business cannot let go of existing employees in order to hire independent contractors.

- Musicians and vocalists who do not receive royalties from the work that they create in any engagement are not completely exempt from the ABC Test. Instead, they “shall be treated as employees solely for purposes of receiving minimum and overtime wages for hours worked during the engagement, as well as any damages and penalties due to the failure to receive minimum or overtime wages.”

- Relatedly, AB2257 adds several specific conditions for musicians, musical groups, and other performers that, if met, disqualifies them from exemption from the ABC Test.

- In addition to the industries originally exempted in AB5, AB2257 provides exemptions for many industries related to the music and performing industries, professional services, and other miscellaneous industries, including, but not limited to:

.

Find a full list of the exemptions stipulated in AB2257 here.

.

In addition to widening the exemptions from the ABC Test, AB2257 gives district attorneys, along with the Attorney General and specific city attorneys, the ability “to prosecute an action for injunctive relief” for intentionally misclassifying workers as independent contractors.

.

How do I apply the ABC Test?

.

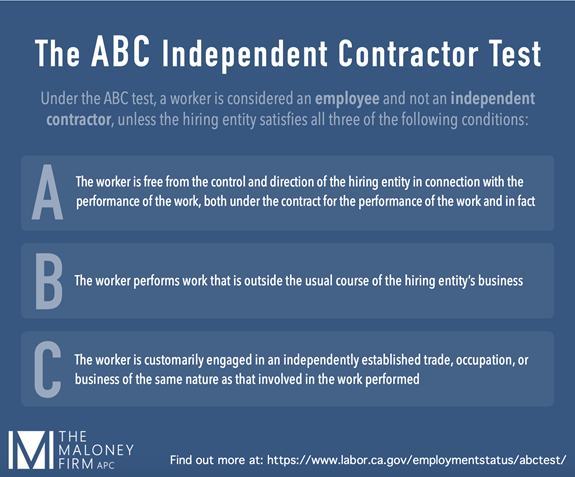

Under AB5 and AB2257, all workers are still considered employees by default. It is the employer’s responsibility to use either the ABC Test or the Borello test (only if exempted from the ABC Test) to prove that their workers are independent contractors. Non-exempted employers must satisfy all three of the ABC Test’s rigorous conditions to lawfully classify their workers as independent contractors. The three conditions are as follows:

.

- A: The worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact;

- B: The worker performs work that is outside the usual course of the hiring entity’s business; and

- C: The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

.

.

Willful misclassification of workers as independent contractors may lead to civil penalties of between $5,000 and $25,000 per violation, in addition to potential penalties for wage violations.

.

The California Supreme Court and California Labor and Workforce Development Agency clarify the application of the ABC Test as follows:

.

Part A:

- A worker who is subject, either as a matter of contractual right or in actual practice, to the type and degree of control a business typically exercises over employees would be considered an employee.

- Depending on the nature of the work and overall arrangement between the parties, a business need not control the precise manner or details of the work in order to be found to have maintained the necessary control that an employer ordinarily possesses over its employees.

Part B:

- Contracted workers who provide services in a role comparable to that of existing employees will likely be viewed as working in the usual course of the hiring entity’s business.

Part C:

- The hiring entity must prove the independent business operation is actually in existence at the time the work is performed. The fact that the business operation could come into existence in the future is not sufficient.

- An individual who independently has made the decision to go into business generally takes the usual steps to establish and promote that independent business.

How Do I Apply the Borello test?

.

Unlike the ABC Test, the Borello test does not rely on any single factor to determine if a worker is an employee or independent contractor. Instead, it is a “multi-factor” test that prioritizes “statutory purpose” and requires a wholistic consideration of all of the available facts. The California Supreme Court specified the following factors that are considered in classifying workers as independent contractors or employees under the Borello test:

.

- Whether the worker performing services holds themselves out as being engaged in an occupation or business distinct from that of the employer;

- Whether the work is a regular or integral part of the employer’s business;

- Whether the employer or the worker supplies the instrumentalities, tools, and the place for the worker doing the work;

- Whether the worker has invested in the business, such as in the equipment or materials required by their task;

- Whether the service provided requires a special skill;

- The kind of occupation, and whether the work is usually done under the direction of the employer or by a specialist without supervision;

- The worker’s opportunity for profit or loss depending on their managerial skill;

- The length of time for which the services are to be performed;

- The degree of permanence of the working relationship;

- The method of payment, whether by time or by the job;

- Whether the worker hires their own employees;

- Whether the employer has a right to fire at will or whether a termination gives rise to an action for breach of contract; and

- Whether or not the worker and the potential employer believe they are creating an employer-employee relationship (this may be relevant, but the legal determination of employment status is not based on whether the parties believe they have an employer-employee relationship).

.

Resources for California Employers

.

Find detailed instructions on how to apply the ABC Test here.

.

Find out more about the Borello test here.

.

Find the full text of Assembly Bill 2257 here.

.

Find the full text of Assembly Bill 5 here.

.

Read more about what “Control of an Employee” means in California here.

.

If you have questions regarding the application of AB5 and AB2257 to your business, contact The Maloney Firm at 310.540.1505.

.