On April 21, 2022, the California Occupational Safety and Health Standards Board (OSHSB) approved an updated third readoption of the Emergency Temporary Standards for COVID-19 Prevention (ETS). This iteration of the ETS will take effect on May 6, 2022, and will expire on December 31, 2022. Learn more about the most significant updates to the ETS below, and view a redlined draft copy of the updated ETS language here.

.

Removal of Definition for “Fully Vaccinated” Employees

.

Previous iterations of the ETS distinguished between fully vaccinated and not fully vaccinated employees for the purposes of testing, face covering, and other such requirements. Significantly, the readopted ETS removes the definition for “fully vaccinated” employees, which carries significant implications for face covering, respirator, and testing requirements, amongst others.

.

Note: For high-risk settings and other specified circumstances, the CDPH continues to distinguish between individuals based on vaccination status in determining close contact, exclusion, return-to-work, and other requirements. Learn more below and at this link.

.

Face Coverings/Respirators

.

Employers must provide all employees, regardless of vaccination status, with respirators upon request, and provide these employees with effective training and instruction related to these respirators.

.

Employees are required to wear face coverings when required by an order from the CDPH. Currently, employees are not required to wear face coverings in the workplace except when they are subject to certain return to work requirements or in certain outbreak settings. Employees who are not fully vaccinated are no longer required to wear face coverings while indoors or in vehicles unless they are subject to a CDPH order.

.

Testing

.

Employers must make testing available at no cost during paid time to all employees with COVID-19 symptoms, regardless of vaccination status, except for “returned cases.” (Learn more about “returned cases” below.)

New Definition: “Returned Cases”

.

Although the readopted ETS eliminates the distinction between fully vaccinated and not fully vaccinated employees, it adds a new category for employees who are “returned cases.” A “returned case” is a COVID-19 case who returned to work pursuant to the applicable return to work requirements and did not develop any COVID-19 symptoms after returning. A person may only be considered a “returned case” for 90 days after the initial onset of COVID-19 symptoms, or for, individuals who never developed symptoms, for 90 days after the first positive test.

.

Employers are not required to make COVID-19 testing available to employees considered “returned cases.” Further, asymptomatic “returned cases” are not required to test for COVID-19 after they are part of an “exposed group” in the workplace.

.

Close Contacts, Exclusion, and Return to Work

.

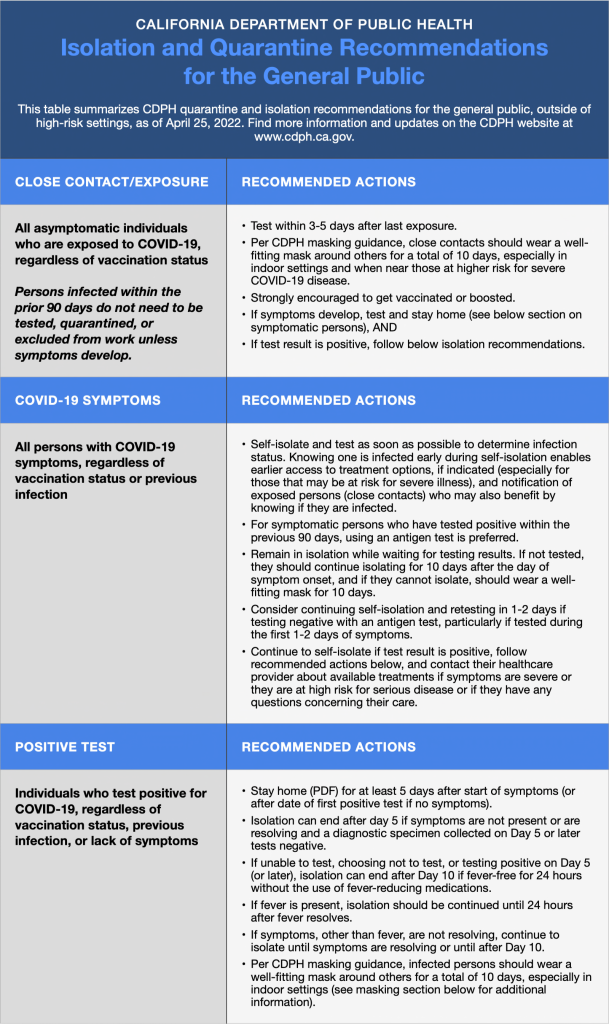

The new ETS defers to the California Department of Public Health (CDPH) to set the standards for responding to close contacts, and for exclusion and return to work requirements. View these standards on the CDPH’s COVID-19 website, linked here.

.

Self-Administered COVID-19 Tests

.

Under most circumstances, employees must take a COVID-19 test to satisfy the ETS’s return to work criteria. The new ETS allows these tests to be self-administered and self-read if another means of independent verification can be provided, such as a time-stamped photograph of the test results.

.

Elimination of “Light Test” for Face Coverings

.

Under the most recent iteration of the ETS, face coverings were required to be constructed of fabrics that “do not let light pass through when held up to a light source.” The updated ETS removes this requirement.

.

Elimination of Cleaning and Disinfection Requirements

.

The prior version of the ETS required employers to implement certain cleaning and disinfection procedures, such as cleaning areas and equipment used by a COVID-19 case during their high risk exposure period. The updated ETS eliminates these cleaning and disinfection requirements.

.

Outbreaks and Major Outbreaks

.

For the purposes of determining when an “outbreak” or “major outbreak” has occurred, the term “infectious period” has replaced “high-risk exposure period.” This update is not substantive; it simply aligns ETS language with CDPH language.

.

Resources for California Employers

.

In the coming weeks, employers should update their COVID-19 Prevention Plans to come into compliance with Cal/OSHA’s updated ETS, and continue monitoring the CDPH website for changes to exclusion, return to work, face covering, and other requirements. As always, employers should stay abreast of mandates from local jurisdictions, which may be more restrictive.

.

Access a redlined draft version of the updated ETS here.

.

Access the CDPH’s Guidance on Isolation and Quarantine for COVID-19 here.

.

If you have questions regarding this article, please contact Patrick Maloney or Lisa Von Eschen of the Maloney Firm’s Employment Law Department.